Key Focus Areas

TGL identifies niche growth areas available to be developed with innovative business models that will ensure adequate revenue streams. TGL’s key focus areas are Financial Services and Tourism in SSA due to the perceived growth potential of these sectors within SADC and its impact on SME development. Own strategic acquisitions are completed to compliments investments in the other two sectors.

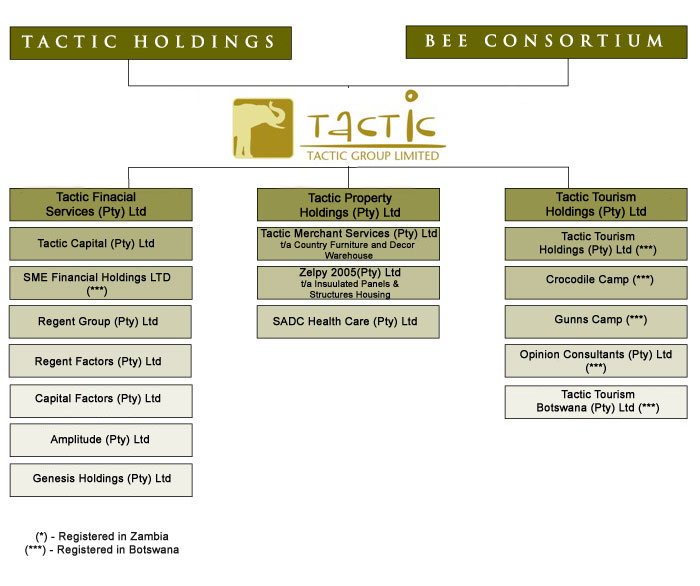

Tactic Finacial Services (Pty) Ltd

-

Pillar 1: Banking (retail and investment banking)

Pillar 2: Specialised finance

Pillar 3: Private Equity Fund Management

Pillar 4: Investment services

Pillar 5: Insurance (short-term and long-term)

Tactic Tourism Holdings (Pty) Ltd

-

Own strategic acquisitions

3rd Party asset management

Training and development

Tactic Property Holdings (Pty) Ltd

-

Strategic Acquisitions in identified niches

-

Financial Services (www.smafinance.biz)

Tactic Financial Services Group (TFS) aims to satisfy

the specific need amongst entrepreneurs and existing SME’s operating in

SSA in terms of obtaining sufficient funding and associated financial

services for starting or expanding their businesses. In addition, there

is a specific need amongst investors wishing to invest in SME’s to

utilise the services of an honest broker with expertise in the SME

market in SSA.

As a consequence of the high transactional cost

involved and inability of small enterprises to provide the collateral

banks require, SME’s find themselves starved for funds at all stages of

their development ranging from start-up to expansion and growth.

TFS has committed to the establishment of a financial services group

(Investment holding company with subsidiaries) that champions the needs

of SME’s in SSA in order to create a sustainably successful future for

entrepreneurs. TFS’s investments in financial services subsidiaries and

their products are intended to address the needs of these entrepreneurs

and SME’s. We envisage that our subsidiaries’ products will be

tailor-made and adapted as research enhances their ability to find

financial solutions to the problems that are currently hampering SME’s

ability to secure funding.

-

Tourism (www.crocodilecamp.com)

Tactic Tourism’s strategy is to invest in boutique hotels and lodges in strategic identified regions in Southern Africa that research has indicated as popular tourism destinations; establish and build a third party management company to manage lodges and boutique hotels; transfer knowledge of tourism and eco-tourism management to Previously Disadvantaged Individuals (PDI’s) and BEE enterprises and the establishment of a specialised Tourism Private Equity Fund that will provide venture capital in the tourism industry.

-

Strategic Investments

Tactic strategy and main objective is to invest in strategic SME businesses in the SSA region for the benefit of Tactic Group.